About Sammons Wealth Management

Meet Stephanie Sammons, CFP®

I’m Stephanie Sammons, Founder/Owner of Sammons Wealth Management. I’m a CERTIFIED FINANCIAL PLANNER™ and Wealth Manager with 25+ years of experience guiding my clients to and through retirement.

Prior to founding Sammons Wealth Management, I served as a VP-level Financial Advisor and held senior leadership roles at UBS and Merrill Lynch for 15 years.

Eventually, I walked away from the corporate world in order to work as my authentic self, serve the clients I truly wanted to serve, and be free of corporate objectives that did not align with the best interests of my clients.

My goal was to create a boutique, client-centric advisory firm that was small by design, and grounded in the values of equity, diversity, and inclusion.

My passion for this work is walking life with like-minded clients to help them realize their most important values, goals, and dreams.

Outside of the Office

I’m married to my long-time partner of 17 years, Texas “Super Lawyer” Kay Van Wey. In fact, we share an office together! We have two adult sons Nicholas and Benjamin, and three puppy dogs; Abbey Road (the Chihuahua in charge), Mia (the sweet Chihuahua), and Sadie, the “indifferent” Australian-Shepherd mix.

When I’m out of the office, I spend time on my passion of songwriting, guitar-playing, recording and performing. I’ve studied the art of songwriting in Nashville with some of the greats, and have been recognized by the Dallas Songwriters Association as an award-winning songwriter. You can stream my music wherever you listen!

Kay and I enjoy outdoor activities such as hiking, golf, biking, snowshoeing, and yes, pickleball, to name a few. I’m an avid reader, researcher, technology geek, and a lifelong Dallas Cowboys fan!

Meet Ashley Klug

Executive Administrative Assistant

Ashley is heading up the firm’s operations management and client service support. She brings industry knowledge and experience after serving in a similar role prior to joining the firm. She is also passionate about serving our clients.

Ashley’s career background includes business management in the healthcare, education, and financial advisory industries.

Ashley grew up in Wichita, Kansas, and graduated from Towson University in Maryland with a Bachelor’s degree in Chemistry and a Minor in Business Administration.

Outside of work, Ashley enjoys life adventures and quality time with her husband, two children, and Annie, their sidekick rescue dog.

About Sammons Wealth Management

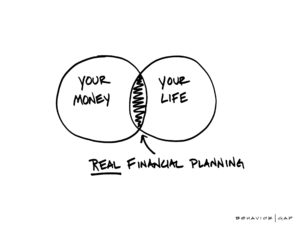

Our mission at Sammons Wealth Management is to help 50+ professionals plan for their ideal retirement and maintain peace-of-mind throughout their retirement journey.

Our clients value their time, high-touch personal service, and the ongoing guidance of an experienced financial advisor.

As an independent fiduciary firm, we do not sell financial products, charge commissions or accept referral fees. We work with trusted platform partners who share our values to provide best in class planning, research, operations, and asset management solutions to our clients.

Sammons Wealth is based in Dallas, Texas, and we serve clients nationwide. Our client accounts are custodied at Charles Schwab.

Our primary custodian for client accounts is Charles Schwab. Schwab is the largest custodian in the U.S. serving independent financial advisors across the country.

We are members of the Certified Financial Planners (CFP®)Organization, the National Association of Personal Financial Advisors (NAPFA), the XY Planning Network, the Financial Planning Association, and the Fee-Only Financial Advisor Network. These associations maintain the highest fiduciary standards for independent, fiduciary financial advisors and have ongoing continuing education requirements for members.

We work closely with a select network of professionals such as attorneys, CPAs, pension consultants, and insurance agents to serve the holistic financial needs of our clients. We do not have a referral fee exchange relationship any of these professionals. We believe that having external partners ensures that our clients receive unbiased and objective recommendations.

Our platform and fintech partners include best in class providers who support the firm in the following areas: investment research, portfolio management operations, financial planning technology, risk assessment, and compliance.

Professional Affiliations